Exness offers a huge number of currency pairs for trading: major, minor, and exotic ones. That gives ample leeway to traders in diversifying their strategies. Each currency pair has its characteristics, and if the trader knows how the market works, he will be able to make informed decisions. Currency pairs are categorized as major, minor, and exotic, depending on the liquidity and volume of trade of the currencies involved. Exness gives access to the most popular and less traded pairs to enter diverse markets and profit from price fluctuations.

Types of Currency Pairs Offered by Exness

Exness offers a wide array of currency pairs for all types of traders. These include major currency pairs, minor currency pairs, and exotic currency pairs. Each of these types has different characteristics, levels of liquidity, and trading opportunities that would suit both novice and professional traders with different trading strategies.

Major Currency Pairs

Major currency pairs are more traded in the world and usually include the US dollar coupled with other currencies of high value. These include popular pairs like EUR/USD, GBP/USD, USD/JPY, and USD/CHF. Because of their high liquidity and low spread, they will be ideal for long-term investors and even short-term traders. Major pairs also tend to be less volatile compared to minor or exotic pairs, thus making them a safer option for those looking to minimize risk and optimize their trading strategies. Being able to trade major pairs holds the possibility of quick order execution and smoother entry and exit from the market to ensure efficient trades with competitive fees.

Minor Currency Pairs

Minor currency pairs, otherwise known as cross-currency pairs, are those that do not involve the US dollar. Examples of such pairs are EUR/GBP, GBP/JPY, and EUR/AUD. These pairs provide somewhat wider spreads than major pairs but still allow ample opportunities for traders who would want to diversify their portfolios and capitalize on fluctuations between strong currencies. Usually, minor pairs are influenced by economic events in specific regions-for example, the central bank’s policies and economic indicators-which make them favorite instruments for fundamental and technical analysis. Although they may lack the liquidity level of major pairs, traders still can control and hedge risks properly by using the appropriate risk management strategies.

Exotic Currency Pairs

Exotic currency pairs are built with one major currency and the currency of either a smaller or an emerging economy: USD/TRY or EUR/ZAR. These wider spreads and highly volatile pairs may create high potential profits but also great risks. Exotic pairs are usually less liquid, which makes them much more sensitive to the market and geopolitics. These can indeed be very exciting opportunities for traders who have a high-risk tolerance, provided they are leveraged correctly. Exness offers competitive spreads and low fees, providing the necessary tools to take advantage of the dynamic market of exotic currencies while managing risk effectively.

How to Choose the Right Currency Pair for Trading on Exness

When selecting a currency pair for trading, consider factors like market volatility, your risk tolerance, and the time of day you’ll be trading. For example, major pairs such as EUR/USD or GBP/USD tend to have more liquidity, making them easier to trade. These pairs are often less volatile, which might be preferable for beginners. On the other hand, exotic pairs are more volatile but can provide the opportunity for greater price movements and are appropriate for well-experienced traders who can afford to take higher risks.

It is also good to be tuned with international economic news and events that may affect specific currencies. If you’re a beginner trader, it’s best to start trading with pairs including your local currency since you may know its behavior more. Always follow the market before entering the trade by using tools such as technical analysis or some kind of risk management strategy.

Benefits of Trading Currency Pairs on Exness

Trading currency pairs on Exness provides several key benefits for traders:

- Low Spreads: Exness offers tight spreads, helping reduce trading costs.

- Access to Major and Minor Pairs: Traders can access a wide range of forex pairs, including popular currencies like USD, EUR, GBP, and others.

- Leverage Options: Exness offers high leverage, allowing traders to control larger positions with less capital.

- Real-Time Market Data: The platform provides live market data, helping traders make informed decisions.

- User-Friendly Platforms: Exness supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both equipped with tools for technical analysis and automated trading.

With Exness, traders can benefit from flexible trading conditions and a secure environment, making it a strong choice for those looking to trade currency pairs effectively.

How to Trade Currency Pairs on Exness

The trading of currency pairs is possible at Exness only in the case of opening an account, choosing a certain currency pair for trading, and availing of the opportunities given by this or that trading platform. Among the other advantages are quite competitive spreads, real-time data, and advanced platforms such as MetaTrader 4 and MetaTrader 5.

Steps to Start Trading Currency Pairs on Exness Platforms

- Open an Exness Account: Visit the Exness website, sign up, and complete the registration process. You will need to provide your email address, personal details, and go through the identity verification steps to ensure account security.

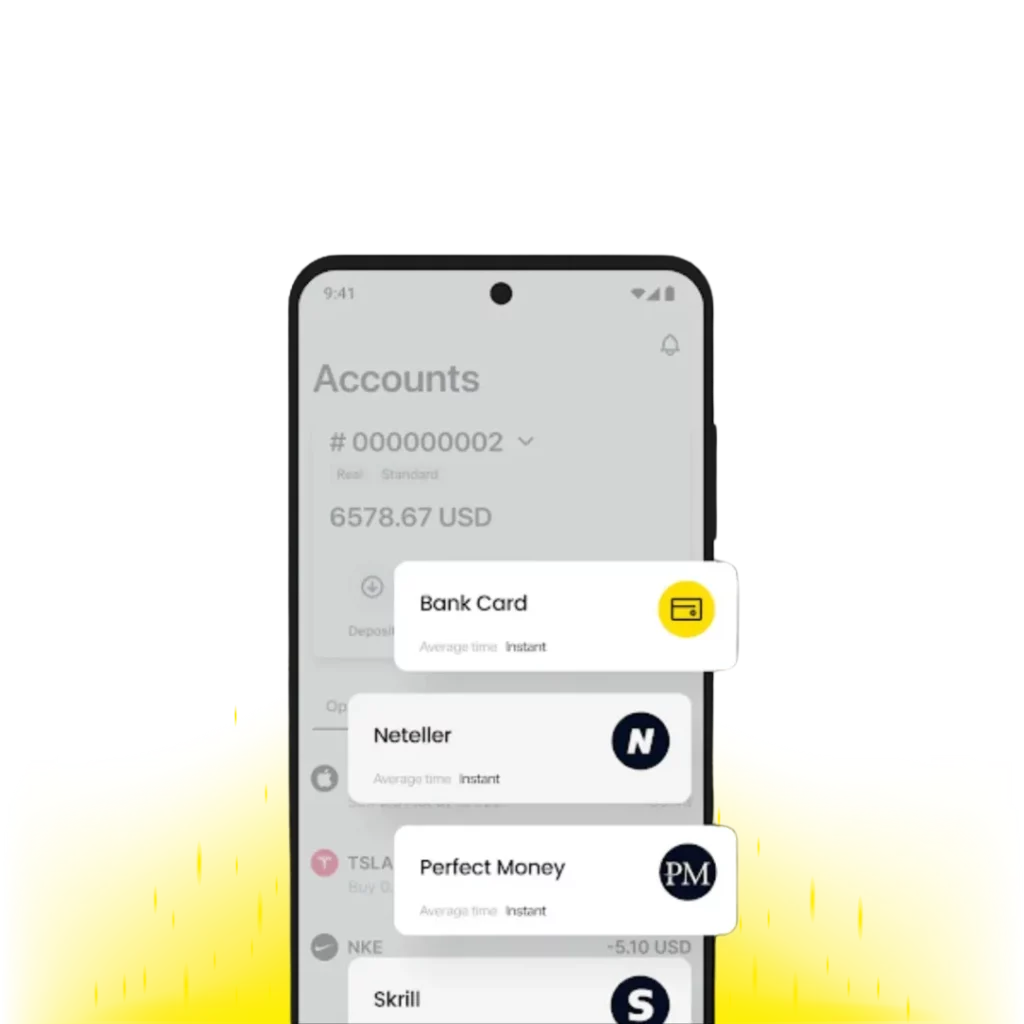

- Deposit Funds: After your account is verified, deposit funds using one of Exness’ supported payment methods like bank transfers, e-wallets, or cryptocurrency. Choose a method that works best for you based on transaction speed and convenience.

- Choose Currency Pairs: Once your account is funded, access the trading platforms (MT4, MT5, or Exness Web) to select the currency pairs you want to trade. Exness offers a wide range of major and minor pairs to choose from, such as EUR/USD, GBP/USD, and others.

- Execute Trades: Using the platform’s intuitive interface, you can place buy or sell orders for the selected currency pairs. Set your stop-loss and take-profit levels to manage risk and secure profits.

Exness provides real-time market data and tools for effective trading, making it easy for traders to analyze trends, spot opportunities, and act swiftly.

Using Exness Tools for Currency Pair Analysis

Exness has many tools for comfortable analysis of currency pairs. The MetaTrader platforms, MT4 and MT5, have inbuilt technical analysis tools such as indicators, oscillators, and trend lines that help identify potential entry and exit points for trades. Thus, traders will be able to make an informed trading decision and predict the market movement more precisely by using these tools.

Exness also provides real-time market data and charting for tracking currency pair prices, studying historical data, and performing fundamental analysis. The ability to access live news updates and market reports further enhances your analysis, keeping you updated on economic events that might influence the prices of currencies. This will help in building up and refining your trading strategy for better success.

Risk Management When Trading Currency Pairs on Exness

Risk management is crucial when trading currency pairs on Exness due to the volatility of the forex market. Here are key strategies to manage risk effectively:

- Set Stop-Loss and Take-Profit Orders: Always use stop-loss orders to limit potential losses and take-profit orders to lock in profits when the market reaches your target. This helps prevent emotional decision-making and protects your capital from major market swings.

- Use Leverage Wisely: While Exness offers high leverage, it’s essential to use it carefully. Trading with high leverage increases both potential profits and losses. Only use leverage in moderation to avoid large, uncontrollable risks. Ensure the amount of leverage aligns with your risk tolerance and trading plan.

- Diversify Your Trades: Avoid putting all your capital into a single currency pair. By diversifying your trades across different pairs or even other financial instruments like commodities or cryptocurrencies, you can spread the risk and reduce the impact of a loss in one position.

- Keep an Eye on Market Volatility: Currency markets can be highly volatile, especially during major economic events or news releases. Be aware of the market volatility and adjust your trade size accordingly. You can also use volatility indicators in MetaTrader 4 or MetaTrader 5 to assess potential risks.

- Manage Position Size: Proper position sizing ensures you only risk a small percentage of your trading account on each trade. This is a simple but effective way to control risk and preserve capital over the long term.

By following these risk management practices, traders can better navigate the high-risk forex market and protect their funds while trading currency pairs on Exness.

Advanced Trading Strategies for Currency Pairs on Exness

Advanced traders of Exness can use a variety of methods to better their success in trading currency pairs. Following the trend is one common strategy whereby traders identify the long-term market trends and place trades in the direction of the trend. It can be confirmed with the help of different technical indicators such as moving averages or RSI for the strength of the trend and its possible reversals. Others include range trading, wherein traders purchase at support areas and sell at resistance areas in a consolidating market. There is also breakout trading, whereby traders look to take advantage of a price break above or below key support or resistance levels for a high-volatility move. Advanced traders will also integrate fundamental analysis-as tracking economic news and data-into their technical signals to further refine their entry and exit points. Traders can optimize their strategies to handle the volatility and uncertainty in currency trading by using stop-loss orders, leverage, and a good risk management plan.

Trading Hours for Currency Pairs on Exness

The trading hours for currency pairs on Exness follow the standard market hours of the Forex market, which is open 24 hours a day, 5 days a week, from Monday 00:00 (GMT) to Friday 23:59 (GMT). This allows traders to access the market and execute trades during the entire business week. The market opens Sunday evening and closes on Friday evening, while the key trading sessions are pegged with major financial centers: the Asian, European, and US sessions. Each session alone has its peak activity times, but the most volatility usually occurs when two major sessions are overlapped, like the London-New York overlap. The trading hours of these exchanges can also be accessed with Exness through both MetaTrader 4 and MetaTrader 5, hence providing traders with manifold opportunities across different time zones.

Exness Currency Pair Spreads and Costs

Exness offers competitive spreads on currency pairs, with tight spreads especially for major pairs like EUR/USD. The costs are generally low, making it an attractive option for forex traders looking to minimize their trading expenses.

How Spreads Affect Your Trades

Spreads represent the difference between the buy and sell price of a currency pair. A tight spread means lower transaction costs, which can be particularly important for short-term traders or those using strategies like scalping. Wider spreads can increase your trading costs and reduce potential profits, especially in volatile markets.

Additional Costs to Consider When Trading Currency Pairs

In addition to spreads, traders should be aware of swap rates (or rollover fees) for holding positions overnight. Swap rates depend on the interest rate differential between the currencies being traded. Additionally, some payment methods for depositing and withdrawing funds may incur fees, so it’s essential to check the associated charges based on your chosen payment method.